Four Factors That Determine Business Growth Are “M.E.L.T.”

December 20, 2023

Hosted By

Dan Sullivan

Dan Sullivan

Shannon Waller

Shannon Waller

Dan Sullivan and Shannon Waller cut through the predictions of unlimited business growth. They explain why the cost of four key elements crucial to business success are on the rise. It's a straightforward conversation about what entrepreneurs should anticipate, and practical steps you can take to navigate the changes ahead.

Here's some of what you'll learn in this episode:

- Why we’re entering a working person’s market.

- Why energy is going to be cheap only in the United States.

- How the four crucial factors influence each other.

Show Notes:

90% of all transport happens on water. And the cost of water transportation is going through the roof right now.

Over the next 25 years, the only place where energy will be guaranteed to be cheap is the United States.

The four crucial MELT factors are money, energy, labor, and transportation.

The costs of the MELT factors are going to rise over the next 25 years.

It’s important to find a way to finance yourself that doesn’t involve debt.

You shouldn’t be giving up a lot of your company just to get your growth money or your survival money.

The U.S. is going to start using tariffs for foreign-produced goods.

We're now in a period where the whole world is going through the greatest loss of skilled knowledge and skilled know-how in history, and this period will probably continue for another decade.

It’s going to get more and more expensive to hire really great people.

The last three years have seen the fastest, biggest growth of new industry and new manufacturing in the history of the United States.

Entrepreneurs are successful to the degree that they solve the D.O.S.® issues (dangers, opportunities, and strengths) of their client base.

Automating what used to be strictly human work is a very slow process.

Resources:

Deep D.O.S. Innovation by Dan Sullivan

Your Life As A Strategy Circle by Dan Sullivan

Episode Transcript

Shannon Waller: Hi, Shannon Waller here and welcome to Inside Strategic Coach with Dan Sullivan. Dan, I'm excited because you have identified four factors that entrepreneurs really need to be paying attention to in terms of what's going to happen in business, what's happening in the marketplace, and if entrepreneurs are not paying attention to this, they could be caught unaware. So I want to dive in to something that you're calling Meltdown and it has a fabulous acronym. So please describe what you're seeing and what people need to pay attention to.

Dan Sullivan: Yeah, I think that we've lived over the last 20, 30 years in a period of almost unlimited exponential growth in the world. And all sorts of predictions are being made by futurists that this is the way of the future. But actually, for most things in the world, 2019 might have been the best year that they're going to have during the 21st century. I'm very influenced here by the thinking of Peter Zeihan, and he said that actually the cost of crucial factors is going up. He's identified four, and I took it a little bit further, that there are four factors that really determine whether you're growing very quickly or not growing very, very quickly. So M-E-L-T, MELT, really identifies what those four are.

Shannon Waller: Interesting. Okay. And I also am, thanks to you, watch Peter Zeihan a lot. So what does M-E-L-T stand for?

Dan Sullivan: Generally speaking, the most decisive factors in economic growth are the cost of money, you know, whether you can borrow money for very little or it costs a lot to get that money, then that would include investments too, you know, getting investment money. Number two is energy, the cost of energy, the availability of energy, whether it's really expensive energy or very, very cheap energy. The third one is labor, the cost of getting skilled people to work and really good people to actually transform your ideas into actions and into results. And the fourth one would be the cost of transportation, because 90% of all getting something to someplace else in the world happens on water. And the cost of water transportation is going through the roof right now. So this is actually a new book title for us, and I think it'll be our next book. Not the book we just started, but the next book after that. It'll be called The Great Meltdown.

And because the costs probably for the foreseeable future—and when I say foreseeable, I'm really talking about the next 25 years—the cost of money, the cost of energy, the cost of labor, and the cost of transportation is going to go up. And therefore, the growth of the people who are used to constant growth, that's going to go down, it's going to go down. So productivity is going to go down, creativity is going to go down, trade is going to go down, and profitability and productivity are going to go down, except for those entrepreneurs who can take each of the dangers, the increased cost of the MELT factors, and they can transform them into new solutions. They're going to come out like great winners during this period of time, but they have to understand that we've suddenly, we're living in a totally new world that the last 30 years did not prepare us for.

Shannon Waller: So these are headwinds. This is not a brief tropical storm.

Dan Sullivan: In The Strategy Circle, these are called obstacles.

Shannon Waller: What you're saying, Dan, is this is not a brief tropical storm. These are headwinds that are going to be coming at us for the next 25 years. And to your point, it's not a death knell. It's not a death sentence. But it will slow things down dramatically unless you can transform, as we were also talking about yesterday, obstacles into opportunities. So let's talk about that. So how do people need to be strategic, savvy, on the ball to really win in this environment, which is completely different than what we've been used to? How do people get really specifically successful with these headwinds?

Dan Sullivan: Well, I think the factor of money, let's start with money, that I think that you should find another way of financing yourself besides debt, because debt is going to cost a lot of money. If you can only finance yourself through other people's investments, it's going to cost you more of your company to get investment money. Okay, so those which might have been positives... We had almost free money for the last 30 years if you look at bank rates over the last 30 years. A few bumps with, you know, recessions and that, but mostly money has been cheaper than any time in history. So, for example, Strategic Coach, we always have operated since the 1980s with a "no receivables" policy. Entrepreneurs sign up for a year at a time, and when they sign up they give us all the money for the year ahead of time so we've never had to deal with that as a company, and we always have the money before we produce the goods.

And the other thing is that we operate on a currency exchange between the United States and Canada, so 80% of our dollars which come back to Canada are always U.S. dollars, which over the last 34 years, the average has been 26% difference. So every one of those American dollars has been worth 26 cents more. Those are strategies on our part. But what you want to be doing is staying out of debt and also not giving up a lot of your company just to get your growth money or your survival money for that basis.

And then energy, this is proof that the world's not fair. And that is, there's only one place probably over the next, I would say, next 25 years where energy is going to be guaranteed to be cheap, and that's probably in the United States. Because the United States has everything. It's got coal, it's got oil, it's got gas, it's got wind power, it's got solar power, it's got hydropower. And the other thing is, with the U.S., it's available virtually across the United States. They have great transmission systems. And usually the source of energies are very, very close to where the energy is used. So it's very interesting that in 1990, 80% of all the energy in the world came from fossil fuels. Last year in 2022, 82% of all the energy in the world came from fossil fuels. So if you take the entire impact of the environmental movement over the last 30 years and getting off fossil fuels, it's increased the use of fossil fuels in the world by 2% on top of the 80% that was there all the time, so I don't know what the entrepreneurial movement is for, but I think it's created its own self-sustaining energy, but it's had no impact whatsoever on how the world uses energy, except there's been great efficiencies now in the use of oil and gas and coal.

So this is going to be totally predictable for the next 25 years, and the one country that is going to enjoy the cheapest energy is going to be the United States. So a lot of, for example, Japan moves its factories to the United States. And my sense is that the U.S. will start using tariffs for foreign-produced goods. But they'll say if you make your product somewhere else and you ship it into the United States, there's going to be a tariff on it. But if you move your factory to the United States and hire U.S. workers, there won't be any tariff on your products. And the reason is that the U.S., you'll want to do that. For example, Germany's manufacturing sector right now, the cost of energy is nine times what the United States' is.

Shannon Waller: It's also a multiple of what it used to be because of the direction they've gone in with their energy policies.

Dan Sullivan: Yeah, well, the multiple reflects how much the cost of energy has gone up in Europe just over the last two or three years. COVID produced part of it. And, you know, the lockdowns and the slowdowns of COVID produced some of it, but the other one was they had made themselves totally dependent upon Russian natural gas, and the main pipeline that moves Russian gas into Germany was blown up. So they're scrambling, you know. But if you're an entrepreneur in Europe, then you're going to be subject to these higher energy costs, but also the cost of money is going up at the same time because cost of energy directly reflects how cheap money is going to be.

Shannon Waller: And Dan, what about labor?

Dan Sullivan: Yeah, labor is really interesting because we're now in a period and probably for the next 10 years where the whole world is going through the greatest loss of skilled knowledge and skilled know how to do things in the history of the world. And that's simply because the baby boom generation has now hit retirement age, and the baby boom generation is incredibly bigger than the current generation of 20- to 40-year-olds who are gonna be asked to replace them. So it's gonna be a working person's market for the next 20, 25 years. Hiring really great people is gonna get more and more expensive. But it'll be more expensive in those countries that also have the highest money cost and highest energy cost. These all influence each other. The MELT issues all influence.

Shannon Waller: And to my mind that will, if there are fewer people and fewer skilled people are the ones that you're looking for, in our case, creative individuals, that also means to my mind that there'll be a leaning into technology—and I love your definition of technology as automated teamwork—to compensate that huge loss and demographic impact of baby boomers leaving the labor force.

Dan Sullivan: Yeah. First of all, it's not cheap. I mean, technology is not cheap, and the cost of technology is going to go up. And it doesn't happen as quickly as people think it does. To automate what used to be strictly human work is a very slow process. It takes into effect all sorts of psychological and emotional factors. There's huge political issues tied into it. But the labor costs are going up. The greatest winners are actually blue-collar labor. The reason is that there are far fewer of them. The major economies in the world have actually developed far fewer skilled what you would call blue-collar labor. In other words, carpenters, electricians, plumbers, mechanics, and everything else. And we have an absolute scarcity of these right when they're going to be needed most, especially in the United States. The last three years since 2020 have been the fastest, biggest growth of new industry and new manufacturing in the history of the United States.

Shannon Waller: Yeah, one of the authors I found very insightful about this is Dr. Temple Grandin, who wrote Visual Thinking about people who are great with their hands and look at things visually. And they're the people who can engineer things. And our school system, because it focused on abstract thinking, algebra in particular...

Dan Sullivan: Created a lot of abstract workers.

Shannon Waller: Exactly. So they kind of made, to refer back to our previous bet, a wrong guess and bet on what would be needed in the marketplace. And now we're experiencing the downside of that. So investing in that, if that's your business, would be wise. And then also, because this is something we're both passionate about, creating an organization that is really appealing and attractive to people. Because you're going to be in competition with other companies who also want those same people. So Dan, let's talk about transportation, because this is a big focus for Peter Zeihan and for all of us who move stuff around the world.

Dan Sullivan: Yeah. Well, whether your economy is good or your economy is not good, whether your economy will grow over the next 20 years or whether it's going to really go down a steep slope and possibly fall off a cliff is really a function of the cost of transportation. Over the last 30 years, they've gotten the cost of final product due to transportation down to 1%. Probably they haven't really caught up with the changes yet, but I would say around the world now the cost of transportation has gone up to 5% of final product, if you can get the product at all. I think the issue here, and again, it's proof that the world's not fair, the cost of transportation in the world is due to only one factor, and that factor is the U.S. Navy. So in 1945, the U.S. made an agreement with the free world—that is, the world that wasn't communist—that they would use their Navy to protect all the maritime trade routes in the world. And there's now parts of the world that the United States just doesn't want to send its Navy because there's no value to it as far as America goes.

And American voters and American taxpayers have basically been paying for the safety of the maritime travel world for the last 75 years. And starting probably about five presidents ago, the U.S. is saying, "We did this to defeat the Soviet Union," but I don't know if anybody was aware of it, but the Soviet Union collapsed. Christmas Day, actually, 1991, the Soviet Union collapsed. And there was no reason after that for the United States to actually protect everybody's shipping. And gradually, more and more, for example, the U.S., pretty well, from the standpoint their Navy doesn't operate in the Middle East. And the reason is that we only did that to guarantee the transportation of cheap energy. And since the United States can at any time produce its own cheaper energy, cheaper than the Middle East, it's saying, why are we protecting the energy out of the Middle East when we can produce our own?

Shannon Waller: So with that security guarantee going down or away, does that mean we can expect resurgence of piracy, more conflicts, more territorial disputes, that kind of thing? Is that the implication of that?

Dan Sullivan: Yeah, we can expect the return of history.

Shannon Waller: In other words, that [unintelligible] year period was a blip.

Dan Sullivan: Yeah, we've been living in basically a Valium-induced world for the last 75 years, where everybody was chilled out, and the main drug that kept the world chilled out was the U.S. Navy.

Shannon Waller: And so, it is the return of history.

Dan Sullivan: You know, history is simply the record of everything that people weren't expecting.

Shannon Waller: Good one.

Dan Sullivan: So people who were expecting it's going to be all kumbaya, you know, global world, everybody loves everybody else. I mean, this has been going on for the last 30 years and it ain't, it's going to be back to claws are out. Teeth are out.

Shannon Waller: Globalization, which was such a huge topic. And now it's like, actually, you know, territories, boundaries, borders matter. Return of history is definitely sticking with me. I like that.

Dan Sullivan: This is the great meltdown period of history.

Shannon Waller: Yeah. So in terms of entrepreneurs, knowing this, knowing the issue is more than half the battle, and being very strategic about how you look at these obstacles, how you find opportunities, how you find breakthroughs, how you solve problems for other people. This is going to be the path to success. Is that what you would say?

Dan Sullivan: Yeah, entrepreneurs are successful to the degree that they solve the dangers, opportunities, and strengths of their client base. So my sense is that you can develop this as a thinking tool. We have inflation in the world now, you know, depending on where you are. And the reason is, it's not going to go down because it's not a temporary issue that's driving the cost of everything. If you lose your major generation of people with skilled knowledge and skilled capabilities, it's going to cost you a lot to replace them with new people plus automation. And that's going to be a 10-, 20-year process.

So my sense is that entrepreneurs who are listening to us today is just the higher costs of money, higher costs of energy, higher costs of labor, and higher cost of transportation is the new normal. This new normal is gonna impact your clients and customers. So your best thing would be to do D.O.S. analysis—dangers, opportunities, and strengths—and allow your customers and clients now to think, how do we deal with the higher MELT issues that's gonna drive down their productivity and profitability? I think that's where the new entrepreneurial value creation is gonna be for the next 20, 25 years.

Shannon Waller: Thank you, Dan. I always love to leave our conversations with a very practical to-do, and booking a call to go and talk to a valued client or even prospect about these particular issues and having this framework is something that's very actionable. So, thank you. Very insightful, as always.

Dan Sullivan: Yeah, and the one thing I want to mention is on the energy front is nuclear power. And the very, very cheap energy from other sources gave the world an excuse for ignoring nuclear power. But first of all, nuclear power is very, very advanced compared with what it was 30 years ago. And you can now create a very viable nuclear plant inside of a standard cargo carrying cases. And then you can now create a nuclear, small modular nuclear plant. And it can power a small city, it can power a new factory. And the U.S. has that too. So I'll say that's going to be the big thing. But the other thing is that looking at it from a global standpoint, I would say that if you want to have the best markets and the best customers and the best returns, you have to work out a geopolitical alliance with the country that doesn't really have these problems, which is the United States.

Shannon Waller: Yes, they have all the advantages.

Dan Sullivan: Life's not fair.

Shannon Waller: It's not, but it doesn't have to be. And that's where the opportunity to create...

Dan Sullivan: Well, it's an entrepreneurial. We're not talking about the general population here. We're talking about the entrepreneurs.

Shannon Waller: But the entrepreneurs will be the ones to go in, identify the dangers, figure out the solutions, and then provide those. So, as always, very thought-provoking. Thank you, Dan.

Dan Sullivan: Thank you, Shannon.

Related Content

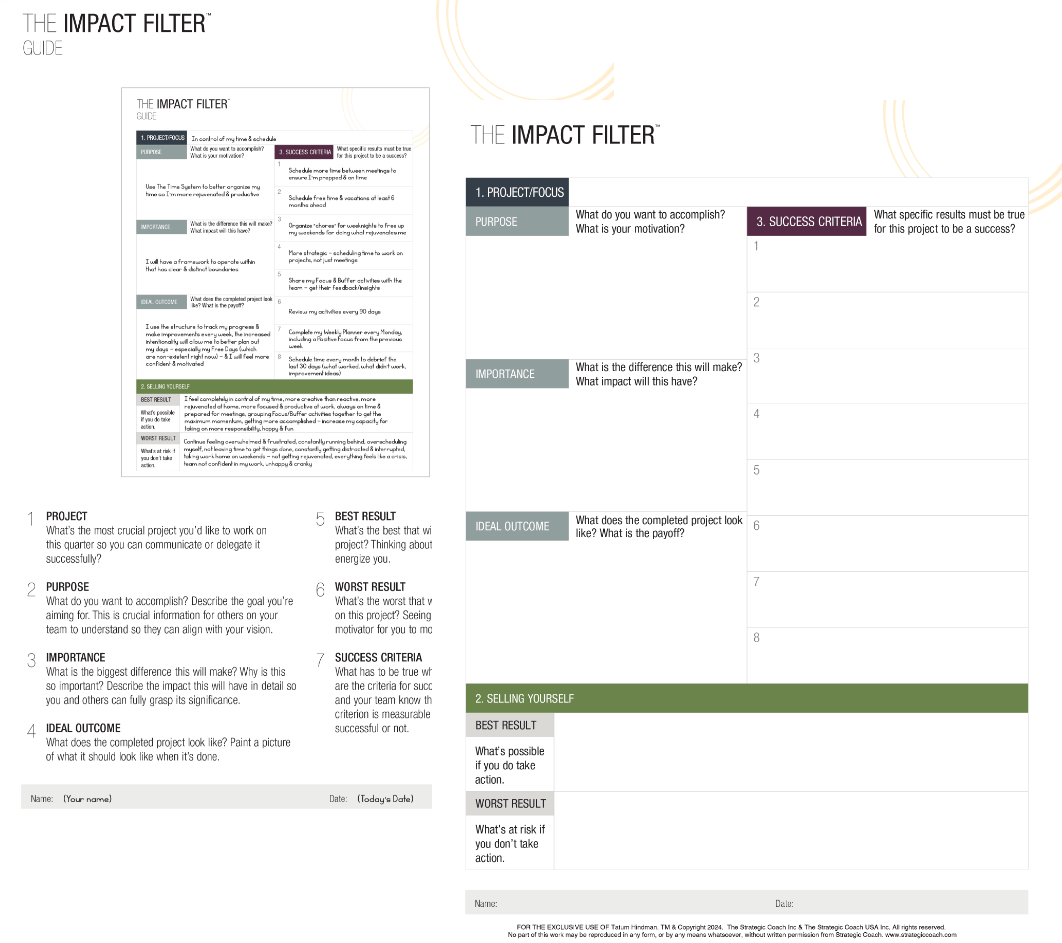

The Impact Filter

Dan Sullivan’s #1 Thinking Tool

Are you tired of feeling overwhelmed by your goals? The Impact Filter™ is a powerful planning tool that can help you find clarity and focus. It’s a thinking process that filters out everything except the impact you want to have, and it’s the same tool that Dan Sullivan uses in every meeting.